Niseko’s Market Momentum: Understanding the Data Behind the Growth

As Niseko solidifies its position among the world’s premier mountain destinations, investors from across Asia and beyond are increasingly drawn to its remarkable growth trajectory. But what exactly is driving this momentum, and what do the numbers reveal about Niseko’s investment potential? Let’s examine the key metrics behind the market’s impressive performance and why the opportunity window remains compelling.

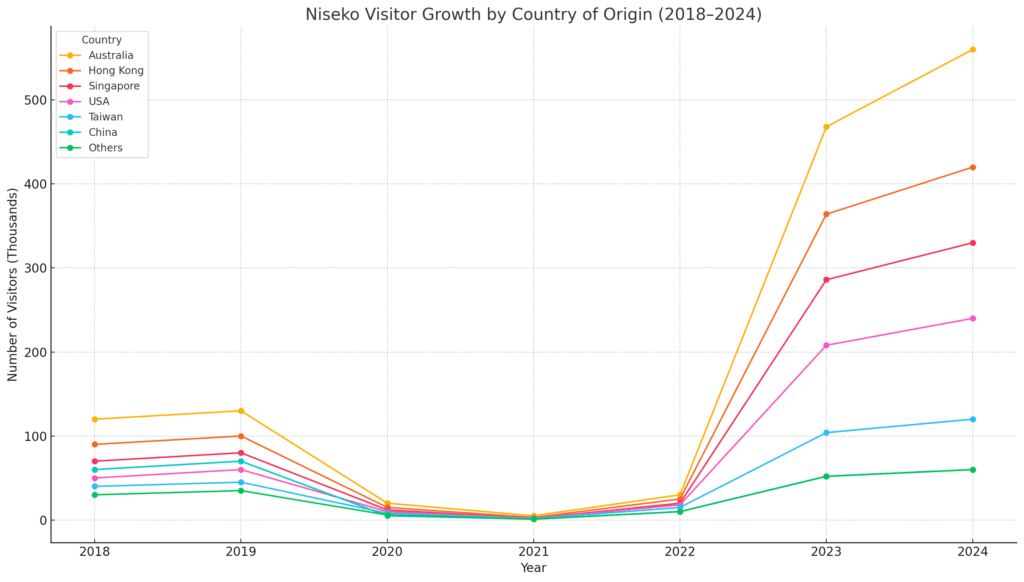

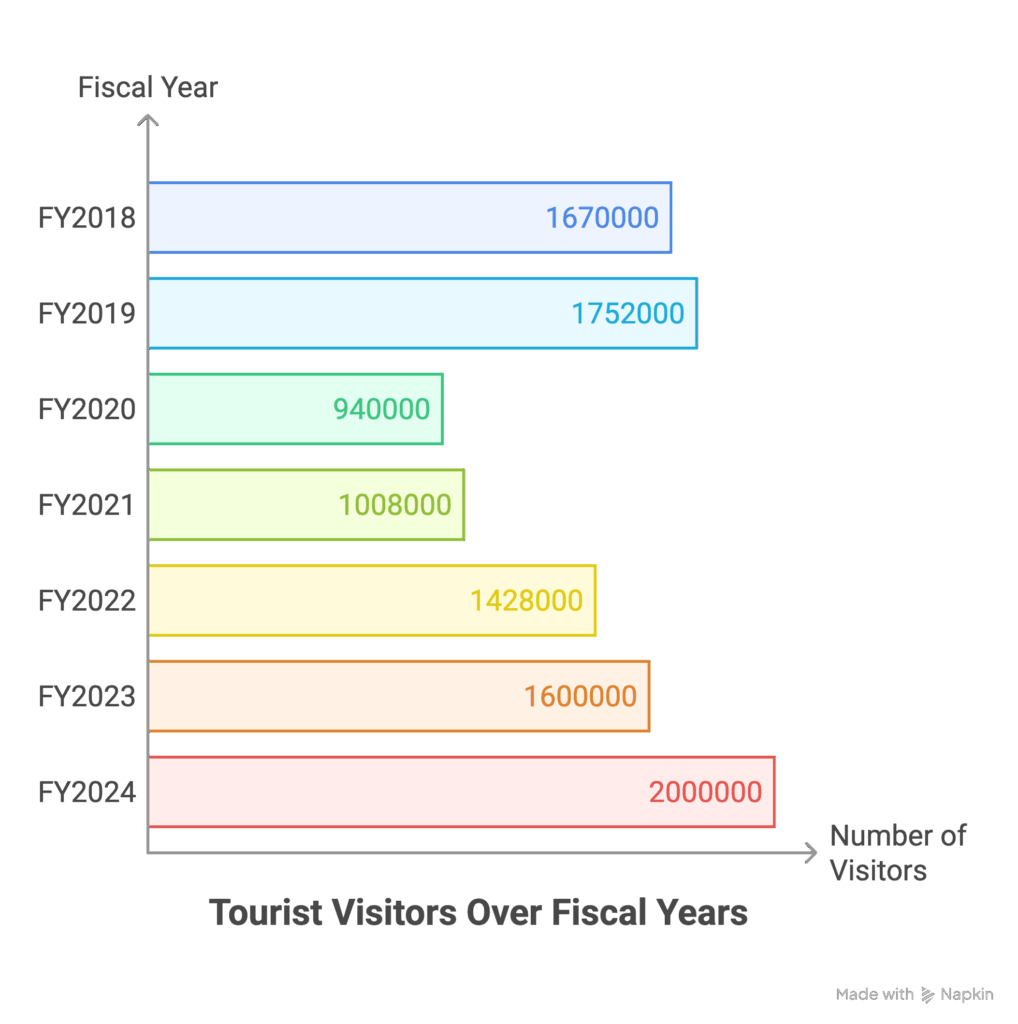

Record Visitor Numbers Fueling Demand

The foundation of Niseko’s real estate success begins with its consistently expanding visitor base. In 2024, the region welcomed approximately 2 million visitors — a significant 12% increase from the previous year. This growth isn’t merely post-pandemic recovery but represents the continuation of Niseko’s long-term appeal to an increasingly global audience.

Winter bookings for the 2024-2025 season demonstrated even stronger momentum, rising by 15-20% year-on-year, with most premium accommodations reporting 100% occupancy during peak periods, particularly around Christmas and New Year.

“The demand we’re seeing isn’t just from traditional markets like Australia and Hong Kong,” notes Yuki Tanaka, director of a leading Niseko property management company. “We’re now welcoming significant numbers from Singapore, Thailand, Malaysia, and increasingly from North America and Europe — a true diversification of our visitor base.”

This consistent and expanding demand creates a solid foundation for rental returns, a critical consideration for investment properties in resort destinations.

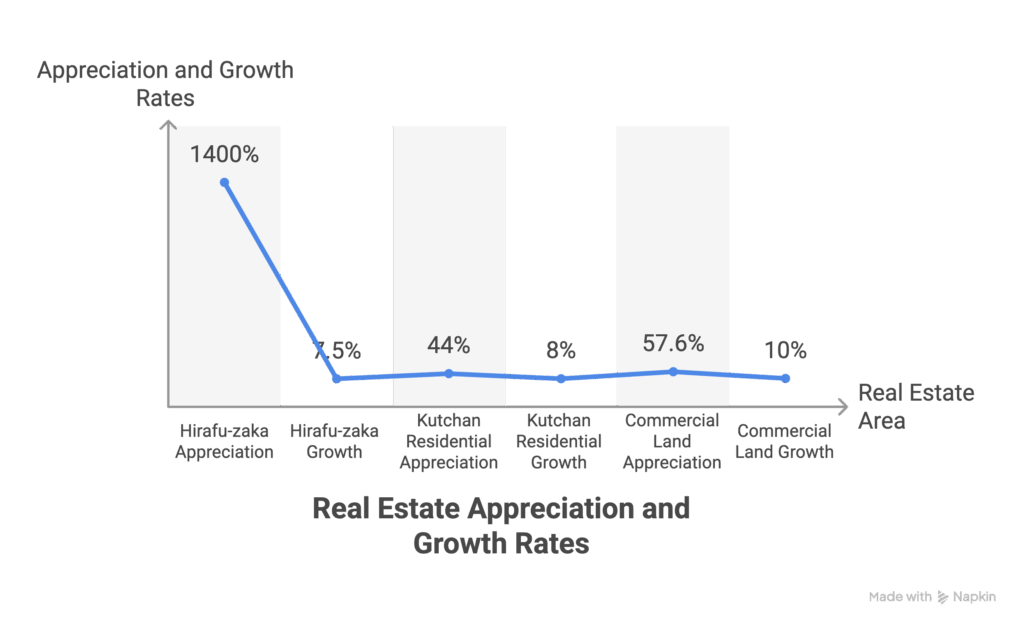

Price Appreciation: The Numbers Tell a Compelling Story

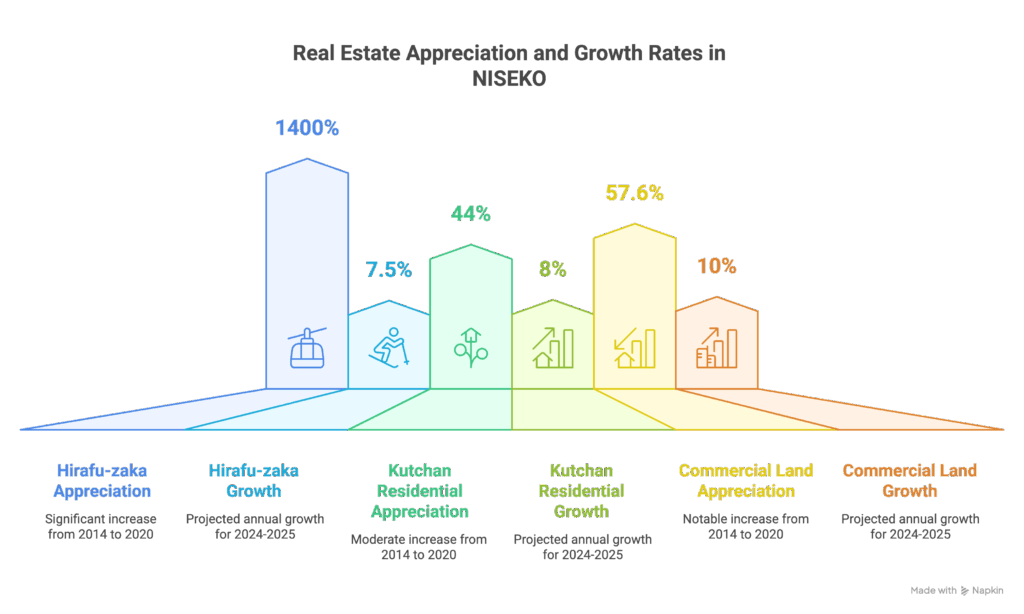

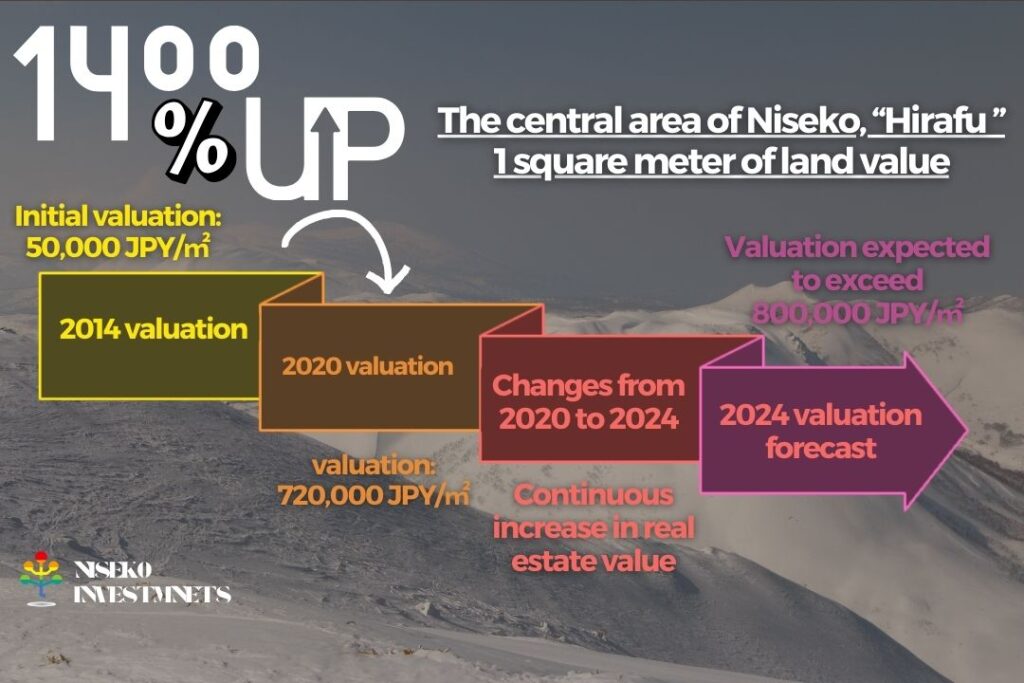

The impact of this sustained visitor interest is clearly reflected in property values across the region:

AreaAppreciation (2014-2020)Current Trend (2024-2025)

Hirafu-zaka area

14× increase

Continuing 5-10% annually

Kutchan residential land

44% increase

7-9% annual growth

Commercial land

57.6% increase

8-12% annual growth

Source: Official land registry data and Niseko Investments market analysis

What makes these figures particularly noteworthy is their resilience through various economic cycles. Even during periods of global uncertainty, Niseko’s property values have demonstrated remarkable stability — a characteristic largely attributed to the cash-based nature of most transactions in this market.

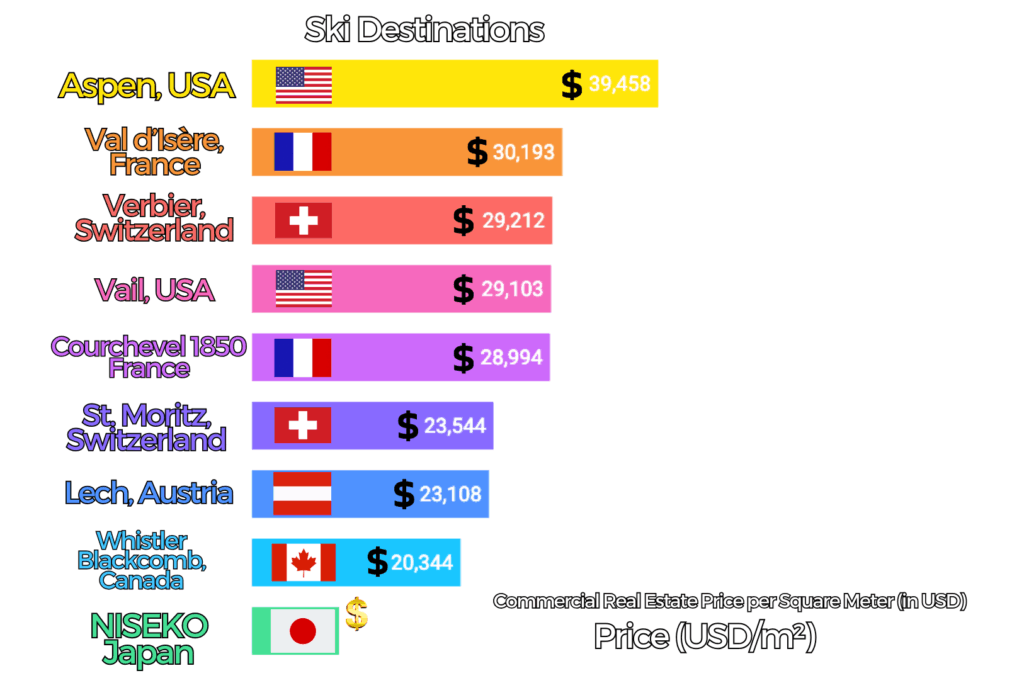

Global Context: Significant Headroom for Growth

Despite impressive appreciation to date, Niseko remains substantially undervalued compared to established international ski destinations. According to a comprehensive 2019 Savills report on global ski property markets, even after a substantial 66.7% increase that year, Niseko ranked only 31st among global luxury ski resorts.

This positioning represents extraordinary value when considering Niseko’s world-class attributes:

- Compared to Courchevel (France), property prices remain approximately 60% lower

- Entry points are substantially more accessible than comparable North American destinations like Aspen or Whistler

- Niseko offers what many consider the world’s finest powder snow (“Japow”) — a natural resource impossible to replicate

- The region continues to develop increasingly sophisticated services and amenities

This pricing differential suggests significant headroom for further appreciation as Niseko continues its maturation as a global destination.

Structural Factors Underpinning Market Stability

Several fundamental elements contribute to Niseko’s remarkable market stability and growth potential:

1. Cash-Dominant Investor Base

Unlike many real estate markets heavily dependent on mortgage financing, Niseko’s property ecosystem operates primarily on cash transactions by high-net-worth investors. This creates a uniquely stable ownership base with reduced vulnerability to economic pressure.

Historical Proof Point: During the 2008 global financial crisis, when many luxury resort destinations experienced significant price corrections and distressed sales, Niseko demonstrated exceptional resilience. Property values remained largely stable as cash-rich owners had the financial capacity to hold assets through market turbulence.

“We saw very few forced sales during the 2008 downturn,” confirms Alan Holmes, a veteran Niseko real estate specialist. “Most owners simply held their properties, continued enjoying them personally, and waited for the market to recover — which it did, quite robustly.”

2. Strategic Infrastructure Development Timeline

The extension of the Hokkaido Shinkansen (bullet train) to Sapporo, now expected in 2038, provides an extended runway for investment appreciation. Rather than creating a rapid spike in values followed by potential correction, this timeline enables more organic, sustainable growth.

This gradual infrastructure improvement also allows developers and local authorities to manage growth more effectively, preserving the authentic character and appeal that make Niseko special in the first place.

3. Sustained Development Pipeline

With over 22 major development projects currently in progress throughout the region, institutional investor confidence remains exceptionally strong. These projects — ranging from luxury hotels and condominium complexes to integrated residential communities — represent billions of yen in capital commitments from sophisticated developers with long-term horizons.

The resumption of the landmark Capella Niseko project, scheduled for completion in 2026, serves as perhaps the most prominent example of this continued confidence in the region’s future.

Risk Diversification Through Seasonal Evolution

While winter remains Niseko’s signature season, strategic investments in summer infrastructure and programming are rapidly extending the region’s appeal year-round:

- Mountain biking trails now attract dedicated enthusiasts from across Asia

- Championship golf courses leverage the stunning mountain scenery

- Cultural events and festivals create new reasons to visit during traditionally quieter months

- Wellness and retreat experiences capitalize on the natural onsen (hot spring) resources

For property investors, this seasonal diversification significantly reduces risk by creating multiple revenue streams and appealing to different visitor demographics throughout the year. Properties that once generated income primarily during 3-4 winter months can now achieve meaningful occupancy across 8-10 months annually.

Market Indicators to Monitor

As you develop your investment strategy in Niseko, several key indicators will help gauge the market’s continued health and trajectory:

1. International Flight Capacity

The ongoing expansion of international flight connections to New Chitose Airport (Sapporo) directly impacts visitor accessibility. Recent additions include:

- New direct flights from Singapore, Bangkok, and Kuala Lumpur

- Increased frequency from Hong Kong, Taipei, and Seoul

- Seasonal direct connections from Australian cities

- Growing charter operations from emerging markets

Each new route opens Niseko to fresh markets and facilitates easier access for existing visitors, directly impacting property demand.

2. Development Completion & Absorption Rates

The successful delivery and market absorption of current development projects serves as a key confidence indicator. Properties like Setsu Niseko, The Vale Reserve, and Kozue have demonstrated strong pre-completion sales, reinforcing market depth.

Monitoring the progress of the Capella Niseko project and other major developments will provide valuable insights into continued institutional confidence.

3. Summer Tourism Metrics

The continued growth of non-winter tourism represents perhaps the most significant potential upside for property investors. Key indicators include:

- Summer occupancy rates (currently averaging 55-65% for premium properties)

- Average length of stay during summer months

- Pricing power during traditionally off-peak seasons

- New summer-focused amenities and attractions

4. Infrastructure Progress

Updates on the Hokkaido Shinkansen extension and local improvement projects will impact long-term value appreciation. While the timeline extension to 2038 has moderated short-term speculation, it has created a longer runway for organic growth.

The Niseko Advantage: Lifestyle Meets Investment

What truly distinguishes Niseko from many investment destinations is the remarkable alignment of lifestyle appeal and investment fundamentals. Few markets globally offer this compelling combination of:

- World-class natural amenities (powder snow, mountain scenery, hot springs)

- Strong historical appreciation with significant growth potential

- Robust rental yields (typically 4-7% net, depending on property type and location)

- Political and economic stability within Japan

- Freehold ownership structures accessible to international investors

For those seeking both personal enjoyment and financial returns, Niseko continues to present an exceptionally compelling proposition — one substantiated by clear market data and strong underlying fundamentals.

Strategic Entry Points in Today’s Market

For investors considering entry into Niseko, several strategies present particularly attractive opportunities in the current market:

1. Value-Add Properties

Older properties in prime locations that can be renovated or repositioned for dual-season appeal often represent excellent value. These properties typically offer:

- Lower acquisition costs relative to new developments

- Prime locations that would be prohibitively expensive for new builds

- Potential for significant value enhancement through targeted improvements

- Immediate rental income during the improvement planning phase

2. Pre-Completion Purchases in Quality Developments

Selected pre-completion purchases in developments by established developers with strong track records can offer:

- Early-investor pricing advantages

- The ability to select optimal units within a development

- Modern designs incorporating dual-season appeal

- Newest amenities and energy-efficient systems

3. Land Banking in Strategic Locations

For investors with longer horizons, acquiring land in areas poised for future infrastructure improvements or amenity development can provide substantial appreciation potential, particularly in:

- Areas between existing developments that may eventually connect

- Locations with exceptional views that remain underdeveloped

- Sites with potential for future lift or gondola access

- Properties near planned summer activity centers

Expert Guidance in a Complex Market

At Niseko Investments, our boutique team closely monitors these market trends and maintains direct relationships with key developers, property managers, and planning officials throughout the region. This network provides our clients with valuable insights often unavailable through larger agencies.

For a personalized analysis of how these market trends might impact your specific investment objectives in Niseko, we invite you to contact our team for a confidential consultation.

Schedule Your Personalized Niseko Investment Consultation →

This market analysis was prepared by Niseko Investments based on data available as of MCONTACTay 2025. While we strive for accuracy in all our research, individual investment performance may vary based on specific property characteristics, timing, and market conditions.