The iconic powder snow of Niseko has long been the region’s defining asset, attracting winter sports enthusiasts and property investors alike. But a strategic transformation is reshaping Niseko’s identity and investment landscape—creating year-round opportunities that savvy investors are already capitalizing on.

The Evolution from Winter Wonderland to Four-Season Destination

For decades, Niseko’s investment thesis has been straightforward: world-class powder snow drives premium winter rental rates that offset the traditionally quiet summer months. Properties would command impressive yields during the December-March peak season, followed by minimal occupancy through spring, summer, and autumn.

That seasonal pattern is now fundamentally changing.

“Five years ago, we’d essentially write off the summer months from a revenue perspective,” explains Alan Holmes, a long-time Niseko property specialist. “Now, well-positioned properties are achieving 60-70% summer occupancy rates and commanding nightly rates that were unimaginable just a few years back.”

Strategic Initiatives Driving Summer Growth

This transformation isn’t happening by accident. Significant investments and coordinated initiatives are deliberately reshaping Niseko’s warm-season appeal:

1. World-Class Mountain Biking Infrastructure

The Niseko Area Mountain Bike Association (NAMBA) has spearheaded the development of an extensive trail network that’s rapidly gaining international recognition. What began as a handful of informal trails has evolved into a sophisticated system catering to every skill level.

Investment Impact: Properties near trail access points are seeing premium valuations, with proximity to biking infrastructure becoming a selling point on par with ski-in/ski-out access in certain sub-markets.

“We’re seeing a significant increase in summer visitors specifically coming for the mountain biking,” notes Takashi Yamamoto, a local tourism official. “What’s particularly interesting is that these are often high-spending visitors who stay for extended periods—sometimes 2-3 weeks compared to the typical 7-10 day winter stays.”

2. Strategic Cultural Programming

The new Niseko Hirafu Green Park—a collaboration between Tokyu Corporation, Cinema Caravan, and local community organizations—has transformed formerly empty winter venues into vibrant summer gathering spaces.

The summer calendar now features:

- Cinema Week: Outdoor film screenings showcasing Japanese and international cinema

- Music Week: Live performances ranging from traditional Japanese music to international acts

- Culinary Festivals: Celebrating Hokkaido’s renowned food culture

- Wellness Retreats: Leveraging the natural hot springs and mountain setting

These initiatives attract both domestic Japanese tourists and international visitors seeking escape from humid Asian summers, with Niseko’s mild climate (average summer temperatures of 20-25°C/68-77°F) providing a refreshing alternative.

3. Premium Golf Experiences

While golf has long been available in Niseko, recent upgrades to existing courses and enhanced international marketing have positioned the region as a golf destination in its own right.

The Arnold Palmer-designed Niseko Golf Course and the scenic Hanazono Golf have both seen significant investments in facilities and services specifically tailored to international guests.

The Investment Mathematics of Year-Round Appeal

For property investors, this seasonal diversification creates a compelling financial proposition:

Enhanced Rental Yields

Properties that once generated 80% of their annual income in just 3-4 months are now achieving more balanced revenue streams:

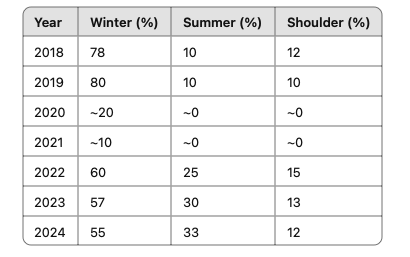

Data Highlight: Analysis of managed properties in Niseko reveals that well-positioned properties have seen their off-season (April-November) contribution to annual rental income increase from 15-20% in 2019 to 35-45% in 2024.

This shift significantly improves overall return on investment while reducing dependency on perfect winter conditions.

Risk Diversification

Climate volatility makes over-reliance on winter sports increasingly risky for mountain destinations globally. Properties generating meaningful returns across multiple seasons provide natural hedging against:

- Late-starting winter seasons

- Climate-related challenges

- Travel disruptions during peak periods

- Changing winter sports participation rates

Operational Efficiencies

Year-round operations create economies of scale impossible in a strictly seasonal market:

- Lower staff turnover due to consistent employment

- Reduced seasonal opening/closing costs

- Better utilization of fixed infrastructure

- More stable local business ecosystem

Strategic Investment Considerations

As Niseko’s identity evolves, investment strategies must adapt accordingly:

1. Location Reassessment

Traditional valuation hierarchies are being disrupted by summer demand patterns. Areas once considered secondary due to their distance from ski lifts may now represent superior value if they offer:

- Proximity to mountain biking trailheads

- Panoramic summer views (particularly of Mt. Yotei)

- Access to summer attractions like golf courses and hot springs

- Connection to outdoor dining and entertainment areas

Pro Tip: Properties in Middle Hirafu and certain parts of Izumikyo that historically traded at 15-20% discounts to Upper Hirafu are seeing this gap narrow as summer appeal equalizes values.

2. Property Feature Prioritization

Design elements and amenities that enhance summer experiences are commanding premium valuations:

- Outdoor living spaces and balconies

- Bike storage and maintenance areas

- Gardens and natural surroundings

- Indoor-outdoor flow

- Natural ventilation (less critical for winter-only properties)

Properties explicitly designed for dual-season appeal are achieving both higher occupancy rates and premium pricing compared to winter-focused counterparts.

3. Strategic Development Opportunities

The summer market evolution has created targeted development opportunities:

- Specialized Accommodations: Purpose-built properties catering to mountain bikers, golfers, and wellness travelers

- Support Services: Equipment rental, guide services, and transportation options

- Hospitality Concepts: Restaurant and entertainment venues designed for summer operation

- Wellness Infrastructure: Facilities leveraging the natural onsen (hot spring) resources beyond winter applications

Looking Ahead: The Convergence of Seasons

As Niseko continues to mature as a destination, the distinction between winter and summer seasons is likely to blur further. Infrastructure improvements, including the eventual Hokkaido Shinkansen extension to Sapporo (though now delayed until 2038), will enhance year-round accessibility.

The most forward-thinking investors are already positioning their portfolios to capitalize on this evolution, recognizing that Niseko’s story is no longer just about powder snow, but about a world-class mountain destination for all seasons.

For those considering entry into this market, understanding both the winter and summer potential of specific properties and locations will be crucial to maximizing returns and building a resilient investment portfolio.

Expert Guidance for Seasonal Diversification

At Niseko Investments, our team has been tracking and analyzing this seasonal evolution since its earliest stages. We’ve developed proprietary data on which locations, property types, and features deliver the strongest dual-season performance.

For investors looking to capitalize on Niseko’s year-round potential, we offer:

- Customized property selection based on dual-season performance metrics

- Summer-specific location analysis that complements traditional winter considerations

- Design consultation for maximizing year-round appeal in new or renovated properties

- Connection to property management services specialized in dual-season optimization

Contact Our Team to Discuss Your Year-Round Investment Strategy →

This article was prepared by Niseko Investments, a boutique real estate advisory specializing in premium Hokkaido properties. The information presented is based on market data as of May 2025 and represents our professional assessment of current trends. Individual investment performance may vary based on specific property characteristics and market conditions.

No comments yet.